Step 3: Calculate the relative market share. It looks at the size of the market, the target audience, the competition, and the economic environment. The process involves performing a quantitative and qualitative assessment of the market. To make sure you’ve got a good handle on the market you need to review, we’d suggest doing a market analysis. If you don’t, the results from the matrix won’t be accurate. To use the BCG matrix template effectively, you need to correctly define your market. Start by identifying the product or services you want to analyze with the matrix.

BCG MATRIX WORD TEMPLATE HOW TO

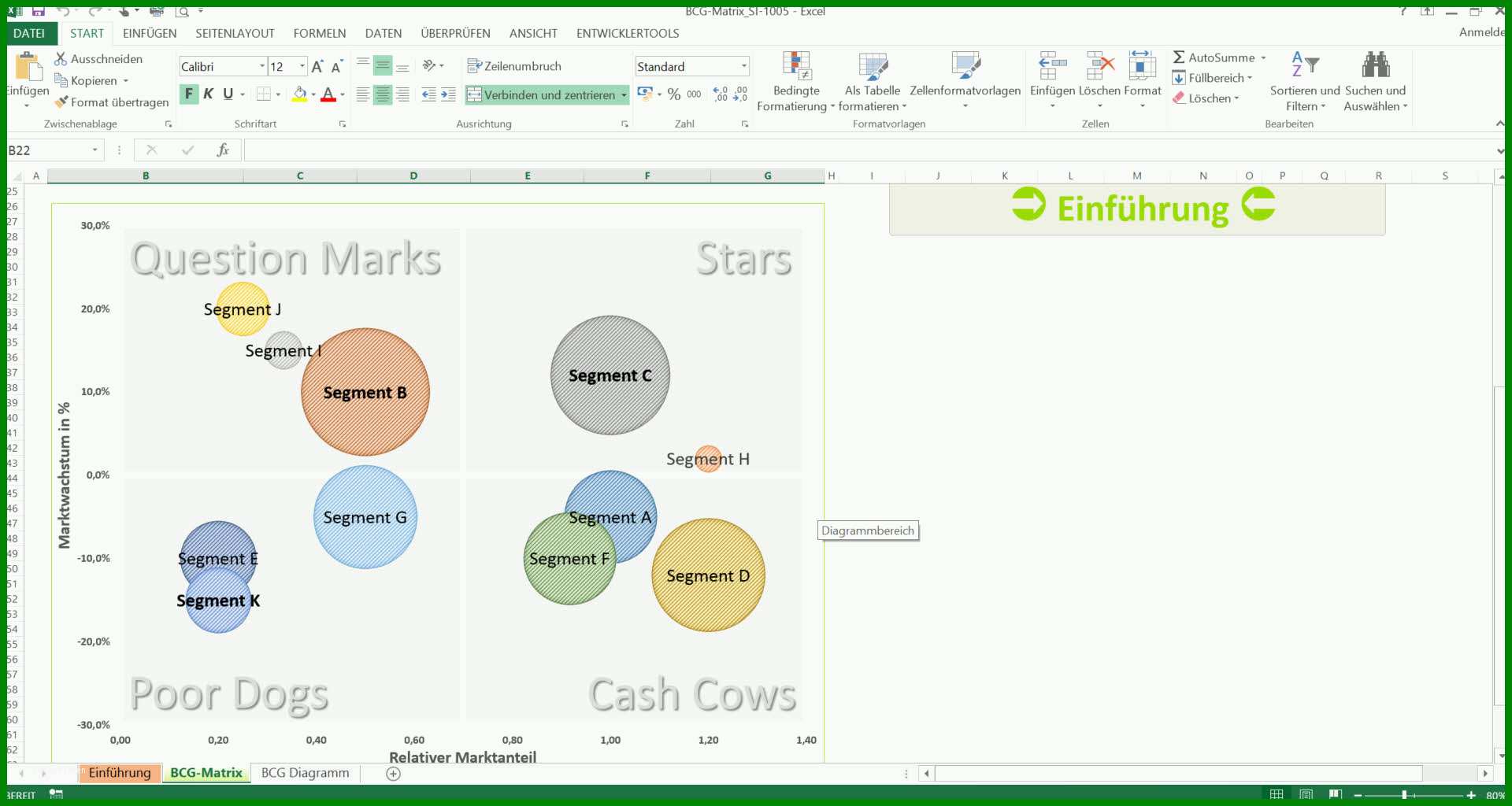

To give you an idea of how to create your own BCG matrix using our template, we’ve outlined a simple step-by-step guide. A completed matrix can be used to assess the strength of your organization and its product portfolio. The simple template allows you to collaborate on portfolio analysis in real-time and takes only a minute to set up. Get started by selecting this BCG matrix template. Miro’s whiteboard tool is the perfect canvas to create and share your BCG matrix. They have graduated from question marks with a market- or niche-leading trajectory. Stars are units with a high market share in a fast-growing industry. Question marks should be analyzed carefully to determine whether they are worth the investment required to grow market share. They could potentially gain market share, become stars, and then become cash cows. Question marksĪlso called “problem children,” question marks operate in a high-growth market yet maintain a low market share. These units typically "break even," generating barely enough cash to maintain the business's market share. Dogsĭogs are units with a low market share in a mature, low-growth industry. These units typically generate cash above the amount needed to maintain the business. These are products or business units with a high market share in a slow-growing industry. To use the chart, analysts plot a scatter graph to rank business units (or products) according to their relative market shares and growth rates. If you’re working with a product portfolio, a BCG growth-share matrix can give you a quick overview of how products are performing and help you build a basis for further analysis. It also helps you find any problem areas or areas of improvement in your existing products.

Reviewing these measurements allows you to identify likely opportunities for growth. This measurement analyzes your current position in the marketplace in relation to your largest competitor. It usually compares growth with the previous year to predict future growth. This measurement looks at the level of revenue growth within the marketplace. There are two key measurements used in the BCG matrix: analyzing the market growth rate and reviewing relative market share. What are the two measurements used in the BCG matrix? With this information, businesses get an insight into which products can help them capitalize on market share growth opportunities.

The BCG matrix divides business units and products into one of four categories based on their market shares. What is a BCG matrix?Ĭreated by the Boston Consulting Group, the BCG matrix (also known as the Boston matrix or growth-share matrix) is a strategic planning tool. In doing this, they can also identify the best areas for growth. Using this template, businesses can see where they currently stand in the marketplace. The BCG matrix template is a four-quadrant grid that allows businesses to visualize where and how they can grow their market share.

0 kommentar(er)

0 kommentar(er)